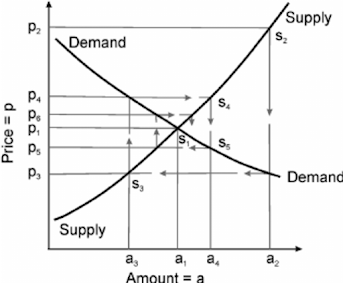

Cobweb theory has played an important role in explaining the endogeneity of price and production cycles in commodity markets. Empirical testing of cobweb models looked into whether 'short run' supply and demand elasticities could cause market instability. Cobweb theory holds that price fluctuations can cause supply fluctuations, resulting in a cycle of rising and falling prices.

In a simple cobweb model, we assume an agricultural market with variable supply due to factors such as weather.

Assumptions of

Cobweb theory

• In an

agricultural market, farmers must decide how much to produce a year ahead of

time, even before they know what the market price will be. (Short-term supply

is price inelastic)

• The

previous year's price will be a key determinant of supply.

• Because

of the low price, some farmers will go out of business. A low price will also

discourage farmers from growing that crop the following year.

•

Agricultural goods demand is typically price inelastic (a decrease in price

causes a smaller percentage increase in demand).

Criticism of Cobweb Theory

1. This is not strictly a trade cycle theorem because it only

applies to the farming sector. There are numerous other areas of production

where it says nothing.

2. This theorem assumes that output is entirely determined by

price. As a result, this is an unrealistic assumption. In reality, the output

of farm products, in particular, is determined by several other factors,

including weather and the prices of the factors of production.

3. It is applicable only where:

i. The price is determined by

the available supply.

ii. When production is governed solely by price considerations as

in greater perfect competition.

Comments

Post a Comment